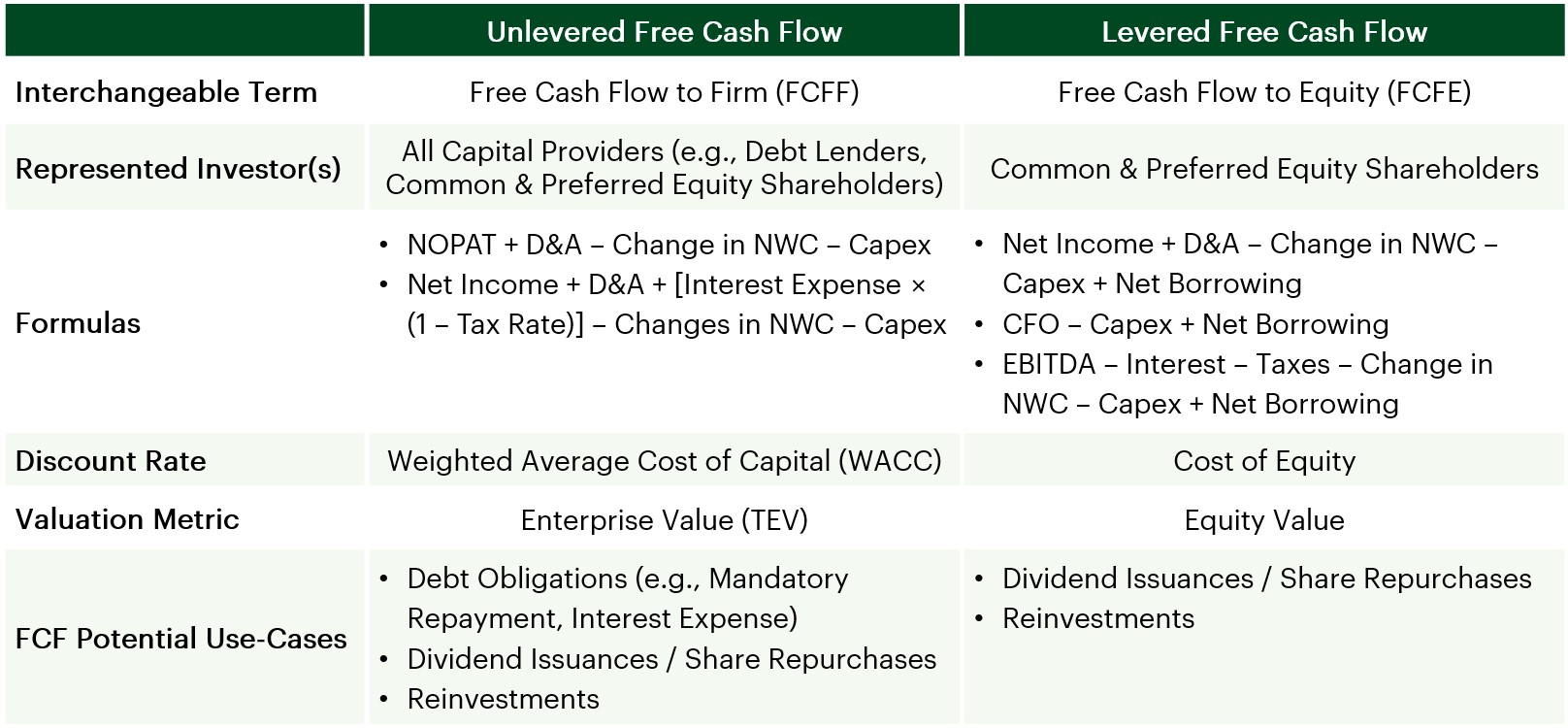

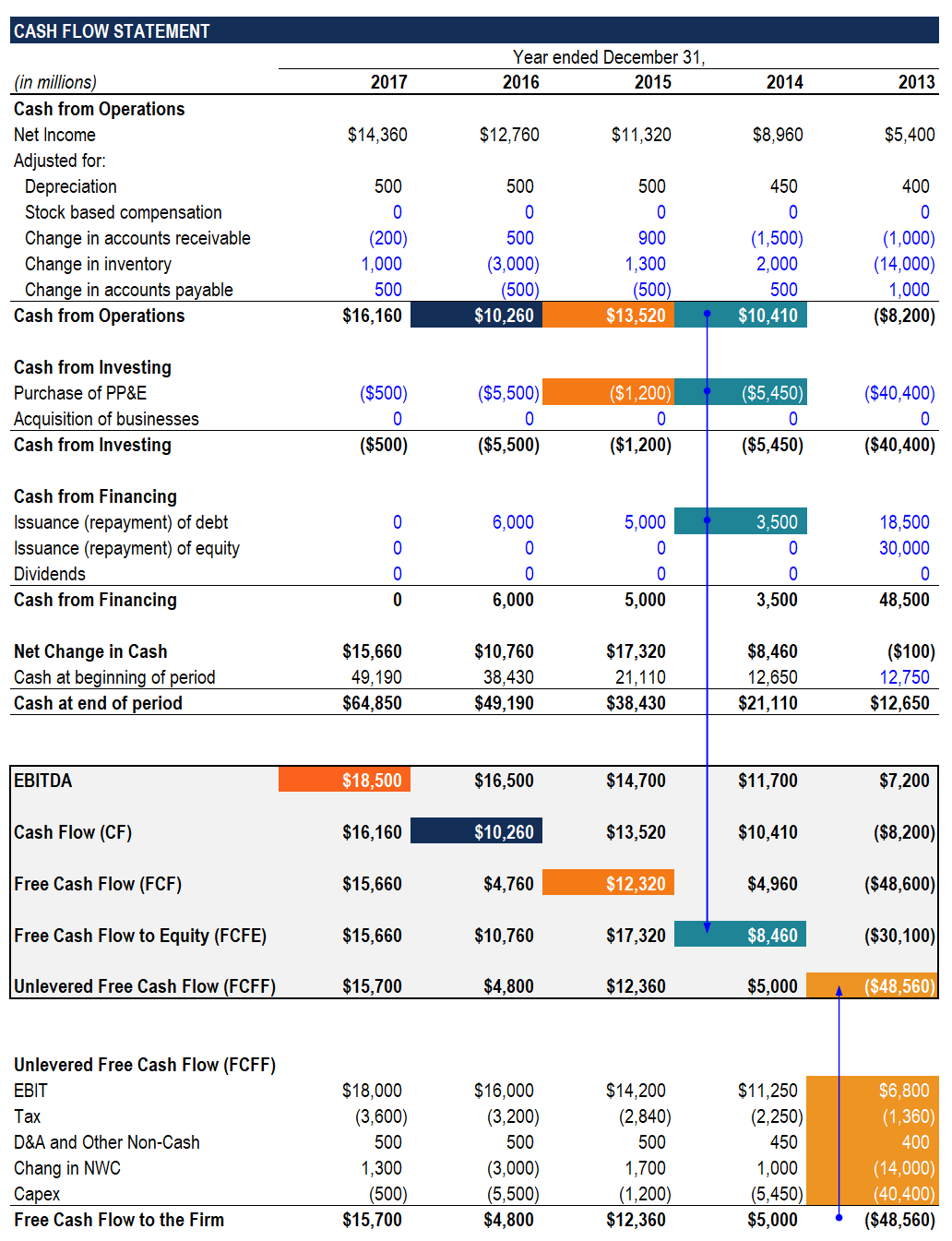

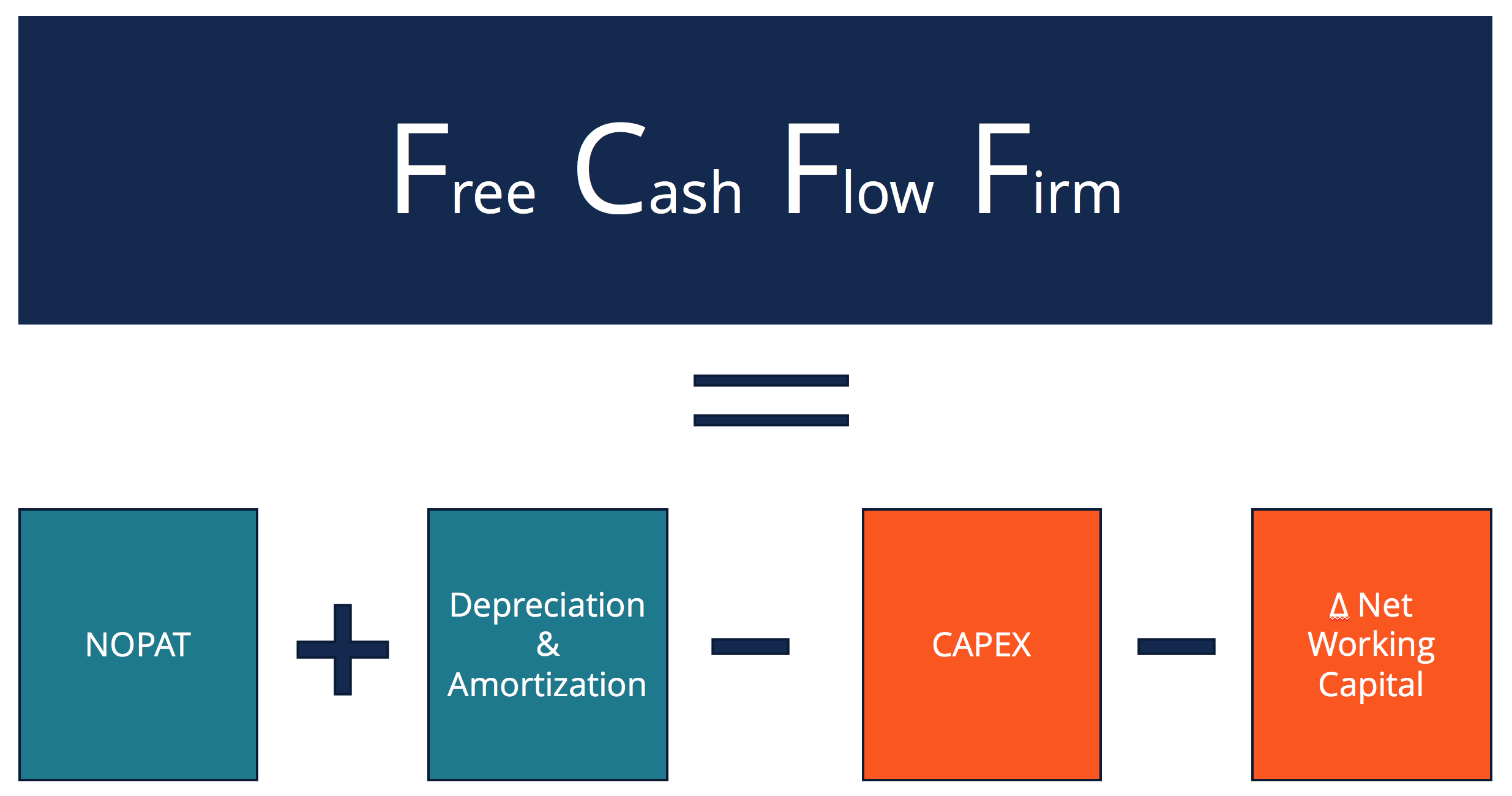

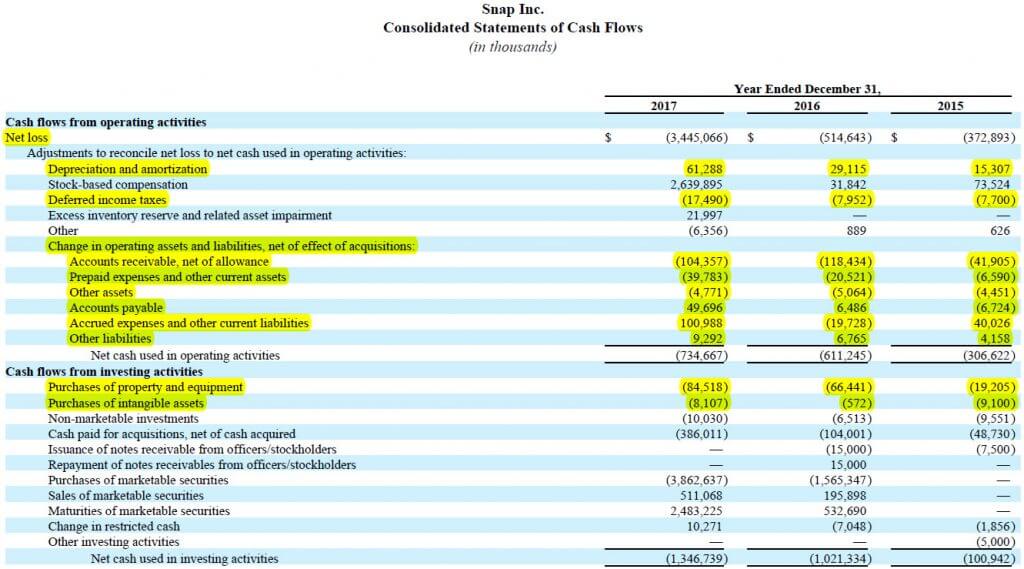

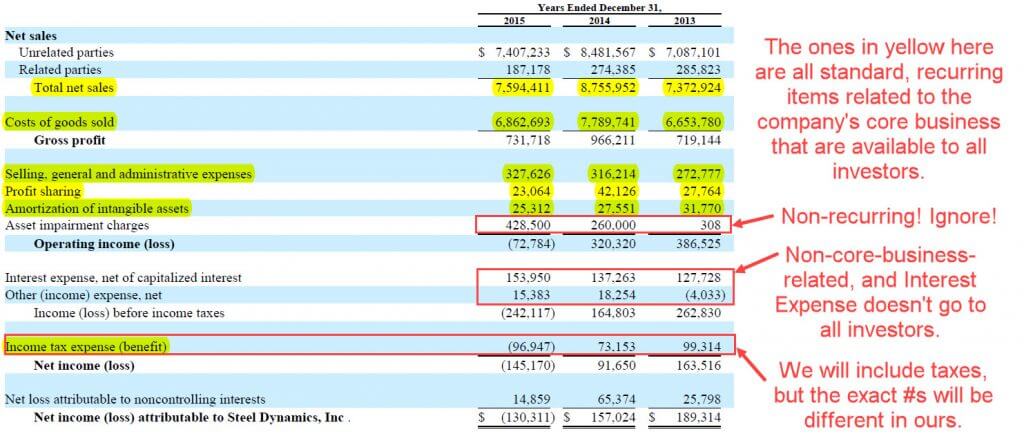

Unlevered fcf is fcf to the enterprise, i.e., the firm. Free cash flow to the firm is synonymous with unlevered free cash flow.

Unlevered Free Cash Flow - Definition Examples Formula

The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation.

Unlevered free cash flow vs fcff. Free cash flow to the firm or fcff (also called unlevered free cash flow. Unlevered free cash flow vs. “unlevered free cash flow (also known as free cash flow to the firm or fcff for short) is a theoretical cash flow figure for a business.

Free cash flow to firm (fcff), commonly referred to as unlevered free cash flow; The fcff and fcfe which are acronyms for (free cash flow for the firm) and (free cash flow to equity), are the two types of free cash flow measures. If the company is not paying dividends;

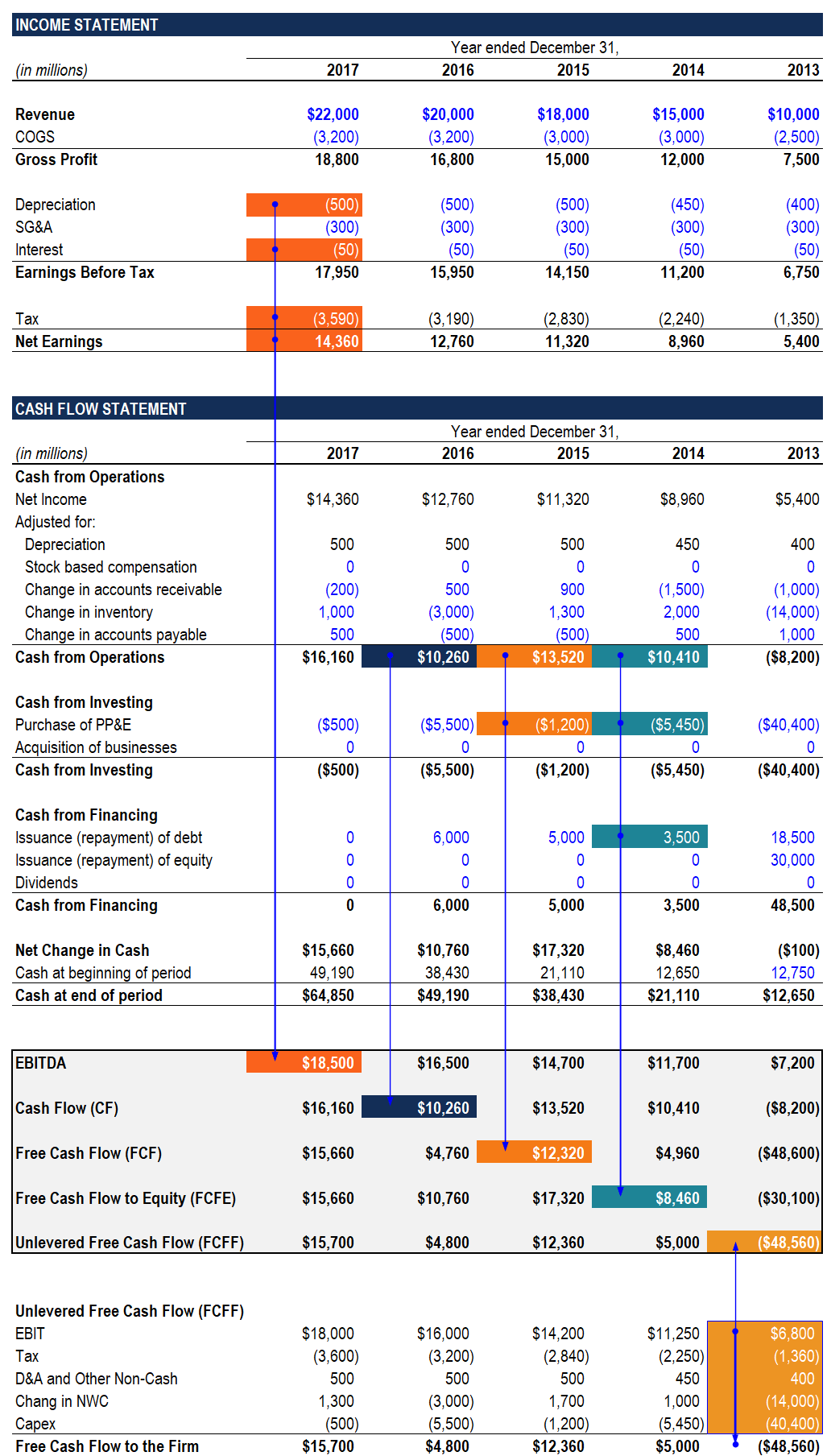

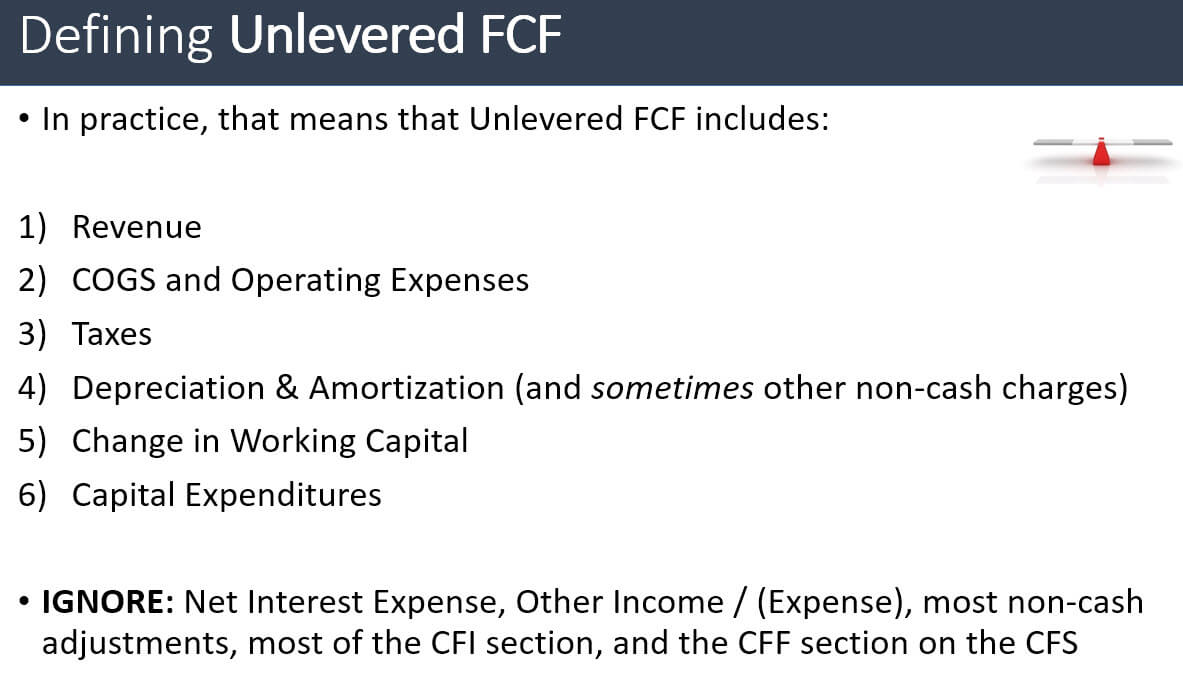

Unlevered free cash flow shows how much cash is available to the firm before taking financial obligations into account. Unlevered free cash flow (also known as free cash flow to the firm or fcff for short) is a theoretical cash flow figure for a business. There are two types of free cash flows:

Unlevered free cash flow (ufcf) is a company's cash flow before interest payments are taken into account. Unlevered free cash flow is the money that is available to pay to the shareholders, as well as the debtors. They are sometimes also referred to as the unlevered free cash flow and levered free cash flow, respectively.

Therefore, you’ll find that unlevered free cash flow is higher than levered free cash flow. Both measures are used to perform free cash flow valuation. Ufcf can be contrasted with levered cash flow (lfcf), which is the money.

It is the cash flow available to all equity holders and debtholders after all operating expenses, capital expenditures, and investments in working capital have been made. Ufcf can be reported in a company's financial statements or calculated using financial. What is unlevered free cash flow?

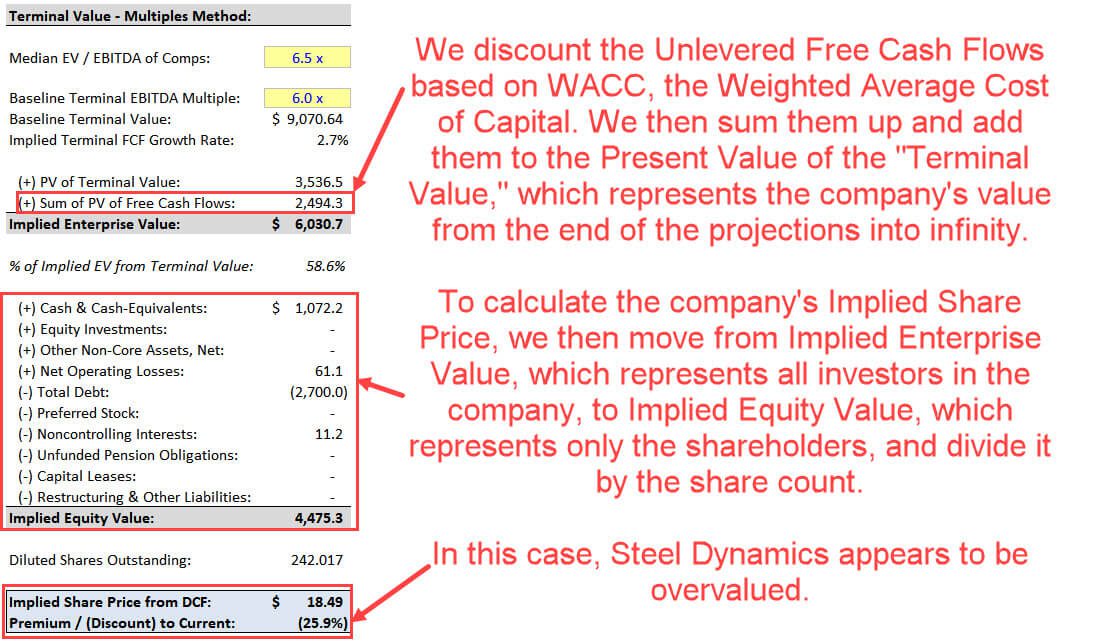

Unlevered free cash flow is used in dcf valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders. Levered free cash flow assumes the business has debts and uses borrowed capital. What is the difference between unlevered vs levered fcf yield?

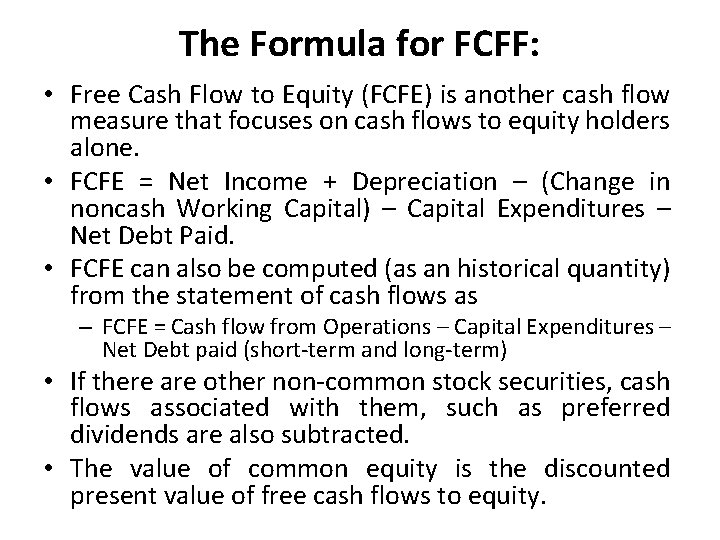

Free cash flow to the firm (fcff) and free cash flow to equity (fcfe) are two types of free cash flow. Free cash flow to firm (fcff) refers to the cash generated by the core operations of a company that belongs to all capital providers (both debt and equity). Unlevered free cash flow is generated by the enterprise so its present value, like an ebitda multiple, will give you the enterprise value.

Unlevered free cash flow unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. It is the cash flow available to all equity holders and debtholders, after all, operating expenses, capital expenditures, and investments in working capital have been made.” It is an indicator of the company's equity capital management read more and free cash flow to firm free cash flow to firm fcff (free cash flow to firm), or unleveled cash flow, is the cash remaining after depreciation, taxes, and other investment costs are paid from the revenue.

Levered free cash flow is the amount that is available to the shareholders (since all debt obligations have been paid out). And free cash flow to equity (fcfe), commonly referred to as levered free cash flow. Free cash flow to the firm (fcff) and free cash flow to equity (fcfe) are the cash flows available to, respectively, all of the investors in the company and to common stockholders.

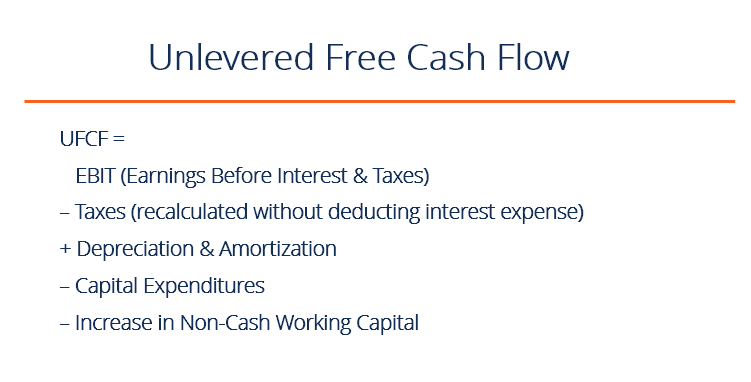

It is vital to understand fcff vs. Based on whether an unlevered or levered cash flow metric is used, the free cash flow yield denotes how much cash flow that the represented investor group(s) are collectively. It is important to understand the difference between fcff vs fcfe as the discount rate and numerator of valuation

Fcfe because the numerator and discount rate of multiples largely depend on the methods of cash flow used. Levered free cash flow is considered to be an important metric from the perspective of the investors. Analysts like to use free cash flow (either fcff or fcfe) as the return.

Unlike dividends, fcfe and fcff reflect the firms capacity. While unlevered free cash flow excludes debts, levered free cash flow includes them.

Free Cash Flow To Firm Fcff Unlevered Fcf Formula - Wall Street Prep

Unlevered Vs Levered Fcf Yield Formula And Calculation Differences - Wall Street Prep

Free Cash Flow Fcf - Most Important Metric In Finance Valuation

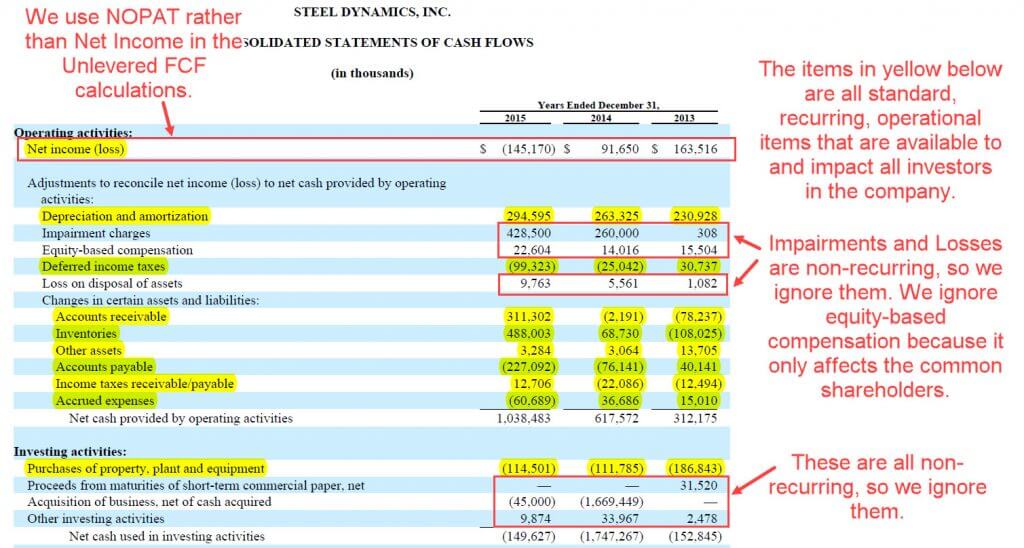

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff And Free

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

Fcff Vs Fcfe - Differences Valuation Multiples Discount Rates

Fcff Vs Fcfe - Differences Valuation Multiples Discount Rates

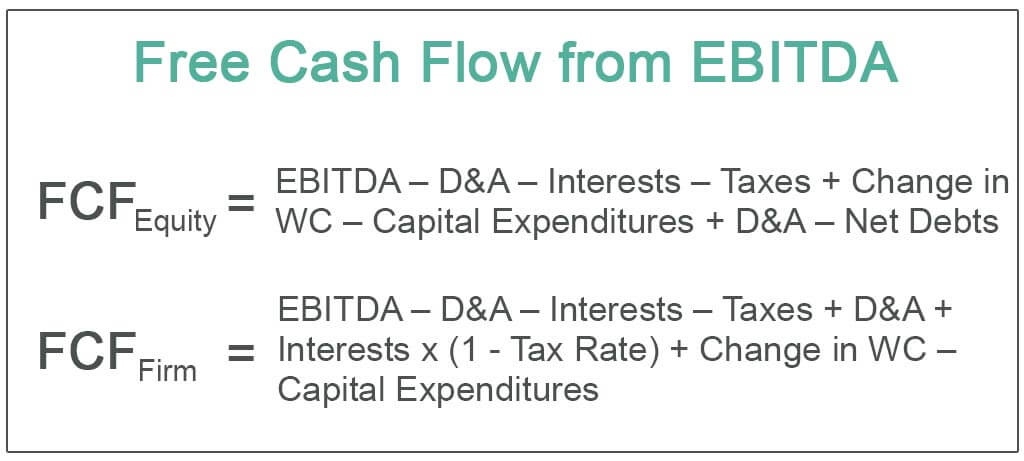

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow To Firm Fcff - Formulas Definition Example

4 Fcff Vs Fcfe - Youtube

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow - Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Free Cash Flow Fcf Definition